Burials & Cremation - We Are Here for You

How Much Does a Funeral Cost?

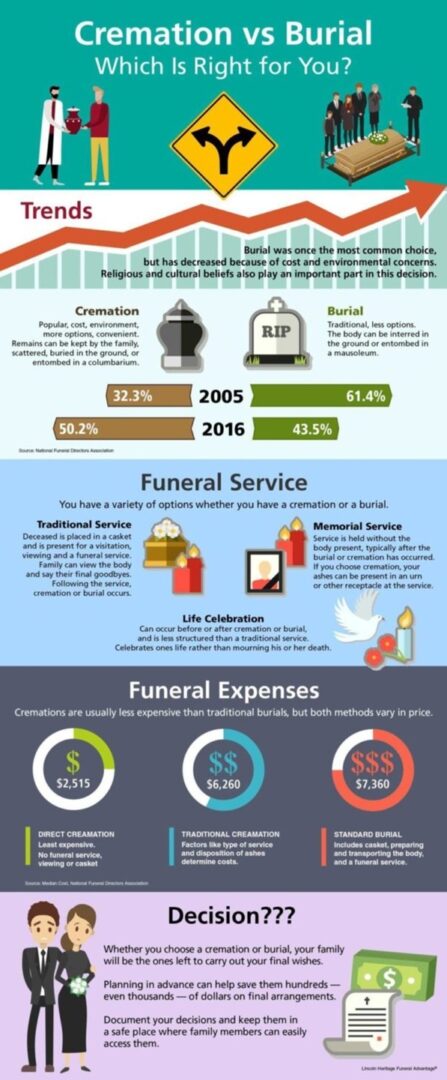

The average funeral costs between $7,000 and $12,000. This includes viewing and burial, basic service fees, transporting remains to a funeral home, a casket, embalming, and other preparation. The average cost of a funeral with cremation is $6,000 to $7,000. These costs do not include a cemetery, monument, marker, or other things like flowers.

Funeral costs have been going up since the 1980’s. Today, it’s normal for the average funeral to cost up to $9,000 or more depending if the body is buried or cremated. Caskets and urns can cost thousands of dollars depending on the style and material.

Pre-planning for events you know will happen can help take some pain out of those expenses for yourself and your family – including funeral expenses.

If you’ve ever helped arrange a funeral, you know even basic funeral expenses can be expensive. If you went in with a budget in mind, the add-ons can send the cost of a funeral out of control.

One of the best ways to control these costs is to plan ahead. Once you know the costs, you can decide which items are must-haves, what would be nice to have, and what you can do without.

What is Burial or Funeral Insurance & How Does it Work?

Burial insurance, also called funeral or final expense insurance, is a helpful tool for loved ones paying for a departed family member or friend’s funeral, memorial service, headstone, urn, and other final expenses. Basically it’s a life insurance policy, but with a much smaller benefit amount than traditional life insurance. It’s usually purchased to cover final arrangements, but can also be used to pay the deceased’s debts, including medical bills, credit card bills, mortgage loans, and personal loans. If you think you and your family may benefit from burial insurance, it’s easy and quick to get a free quote for a burial policy..

Burial Insurance for Seniors

Coverage is usually best for people ages 50 to 85, although most companies offer plans to those as young as 30 days of age. Most burial insurance policies are a type of life insurance called “whole life insurance.” This type of insurance does not expire and is considered paid-up at age 100 in many cases.

Researching this type of plan should be part of every senior’s end-of-life financial planning, but you may not want to wait until you’re retired to start preparing. Plans get more expensive as you age. Most companies actually have a maximum age limit for buying one, so it’s a good idea to look into getting one as early as possible. The younger you are, the cheaper your rates will be. If you’re over 50 and think you will benefit from this type of coverage, look into your options when you’re drawing up a will, updating your power of attorney (POA) and other guardianship documents, and assigning beneficiaries to your financial accounts. Learn more about affordable life insurance for 50-80 years old.

Funeral Insurance Costs & Premiums

Insurance premiums are based on your age, sex, the size of your policy, and your current health. Everyone that seeks coverage — and every company that provides it — is different, so be sure to ask for a personalized quote. Women usually pay less than men for the same coverage. Rates for both men and women increase with age, and you can save a lot of money by answering health questions on your application.

Average Funeral Expense Coverage

Coverage can range between $5,000 and $25,000. Most policies fall around $10,000 for both men and women. When deciding on the amount you’ll need, it’s important to consider what kinds of final arrangements you want, as well as if you want enough left over to cover bills and other debts.

Pros & Cons of Burial Insurance Policies

Pro’s

Cons

The best way to decide if one of these plans is right for you is to do a little research. Reach out to a few companies for quotes and weigh your options after you’ve written out your needs and your budget.

2 Types of Funeral Insurance Plans

There are two basic kinds of funeral insurance: standard and pre-need. Both will help you plan and set aside the funds for all of your final arrangements.

Standard Funeral Insurance

Offered by life insurance companies as a whole life policy, these are paid out to beneficiaries upon the death of a loved one to pay for final arrangements, which may include:

Your loved one is also able to work with any service providers they wish. The beneficiary may choose to apply some or all of the funds to other expenses or debts owed by the deceased, including:

Pre-need Funeral Insurance

Pre-need agreements are offered by life insurance companies and, in some cases, funeral homes. However, these funds are given directly to the funeral home you’ve chosen to work with instead of a designated loved one. They are paid out almost immediately after one’s passing.

Pre-need insurance can help people save money by allowing them to pay for services that may be cheaper today than they will be in the future. However, if you pay more for your plan than you do for your funeral, your loved ones won’t receive the difference (the same is true for burial insurance). That means that if you take out a $10,000 plan but your final arrangements are only valued at $9,000, the funeral home won’t give your loved ones the leftover $1,000.

How to Choose the Best Burial Insurance Plan for You

Choosing the right plan is a very personal decision, and there are many important factors you should consider when making your decision, including:

Shopping for burial insurance is like shopping for a car. Every policy will have the same basic features, but the finer details will separate one policy from another. Make sure you choose a policy that supports the specific reason you’re insuring yourself.

Burial Insurance with No Waiting Period & No Exam

Many providers offer plans that are guaranteed to pay out the full death benefit amount as soon as the first payment is made and the application is approved. This means that if you make a single premium payment and then pass away, your beneficiary will receive the full amount you were covered for (as long as the person was truthful about their health on the application and did not lie about any pre-existing conditions).

These plans require you to answer basic health questions when you apply. You aren’t required to take a medical exam (also called a life insurance exam ), give blood or urine samples, or provide your medical history. The coverage is based on your answers to the health questions on the insurance application. It’s important to answer these questions honestly. If there are any discrepancies, your policy’s claim may be denied.

How to Get Quotes & Buy Online

Many companies that provide final expense insurance offer a free online quote and allow you to sign up on their websites. You can compare multiple policies from several companies to help you narrow down which plan is best for you.

Whether you conduct research on your own or work with a life insurance agency like us, everyone has different needs and signing up for the first or cheapest plan you find, your loved ones may not have all of the funds they need to carry out your final wishes. We’re here to help you evaluate the cost of your final wishes so that your family is spared from any unexpected costs when you pass away.

Burial Insurance Plans for Families

For the most part, there aren’t family plans for burial insurance. Remember, policies are determined by age and sex, and sometimes the applicant’s health. This makes it difficult for companies to bundle individuals together in a family plan.

Alternatives to Traditional Burial Insurance

Many people rely on life insurance to cover their final expenses. This can be a good option, especially if you have a large policy that will cover your final arrangements in addition to other debts and expenses your family will be responsible for after your passing. However, these types of policies have different requirements, rules, and focuses than burial or funeral insurance.

Term Life Insurance

Term life insurance covers you for only a set period of time. Once that period of time is up, you will need to purchase another policy – usually at a much higher rate – to stay covered. If you don’t renew your policy and pass away, there is no policy protection. Because we don’t know when we’re going to die and can’t predict if it will happen within the policy’s term, this isn’t a good option for paying for final expenses.

While you can renew this type of plan, they cost more the older you get, so you may end up paying more money than you would if you signed up for burial insurance. If you’re counting on using term life insurance to pay for your final arrangements, take a look at your policy to see if it can be converted to a whole life or other permanent plan. Exercising this option gets more expensive as you age, so the sooner you do it the better.

Universal Life Insurance

In most cases, universal life insurance isn’t a good option because it relies on interest rates. When interest rates increase, these policies grow in value, but as they fall, it takes more money — in the form of higher premiums — to keep them beneficial to consumers. If you have one of these policies, you may be able to transfer its value to a whole life policy.

Guaranteed Issued Whole Life Insurance

Guaranteed life insurance isn't usually an ideal option simply because it is expensive. There is no health questions involved, which means the provider doesn’t assess the risk of offering coverage to applicants. This usually means everyone pays a much higher premium than they would with traditional whole life insurance to make up for the risk the company is accepting. Because these are often appealing options to individuals who have issues finding life insurance coverage — for example, an 80-year-old man who has suffered three heart attacks — these policies can cost much more than other options

Burial Insurance vs. Life Insurance

Burial insurance is a type of life insurance, but it has a much smaller benefit amount than traditional life insurance policies. This is because burial policies are meant for taking care of final expenses only, while life policies are taken out to cover a wide array of needs such as income replacement.

Although payouts from burial insurance can be used for other expenses at the beneficiary’s discretion, benefit amounts are tailored to cover only final arrangements. That’s why they’re usually offered in amounts of $5,000 to $25,000, whereas traditional life insurance can offer benefits of hundreds of thousands of dollars.

Planning for a Funeral

However you’re paying for it, there are many considerations you’ll need to make when funeral planning for yourself or a loved one

Cremation or Burial?

It’s important to first decide whether you want to be cremated or buried because the costs vary depending on your choice. Choosing your final arrangements will help you know what other items you’ll need to consider. For a funeral, you’ll want to consider the cost for a headstone, casket, and opening and closing the grave. For a cremation, you’ll need an urn or other container and decide whether you want a memorial service.

Decide on a Memorial Service

Planning a memorial service is an important part of the grieving process for most friends and family. Whether you’ve decided to be buried or cremated, the body can be present at the memorial service. Even with cremation, you can ask the funeral home you’re working with to embalm the body so it can be viewed during the service and then cremated after.

More and more people are personalizing the way they pay respects to their loved ones. Some ideas you may want to consider for celebrating a loved one’s life include

As with the entire funeral-planning process, you and your loved ones should do whatever brings you comfort and peace.

Research and Contact Service Providers

Once you have a clear understanding of what you’re looking for, it’s time to research and reach out to service providers who can help you carry out your vision.

Whether you’re pre-planning your own arrangements or carrying out the wishes of a loved one who has recently passed away, speak with multiple funeral homes to get quotes for everything you want included. Be sure to discuss factors such as:

If your loved one had a burial or funeral insurance policy to help cover the cost of their funeral, your job will be much easier. Reach out to the insurance company where they took out their policy, and they will help you understand how much benefit is available and how it can be paid.

Let Your Loved Ones Know Your Final Wishes

Planning in advance for your own final arrangements will be wasted if you don’t let your loved ones know exactly what your wishes are. Make sure you document your final arrangements and let those closest to you know so they can carry them out when the time comes.

Ideally, your end-of-life wishes should be written down, and you should have multiple physical copies in secure places that at least two of your loved ones have access to. These safe spots may be a home safe, safe deposit box, and/or with your attorney if you have one.

It’s also a good idea to have at least one heart-to-heart conversation with your parents, partner, children, or other trusted family members and friends about what you hope will happen after you pass away. It’s a difficult conversation to have and one that should be handled with care, but it’s an important discussion that will ultimately bring peace of mind to both you and your loved ones.